2024

NAFIS DWI KARTIKO: PROFESSIONAL CLASS STUDENT WHO REGULARLY MAKES ACHIEVEMENTS IN THE FIELD OF SCIENTIFIC WRITING.

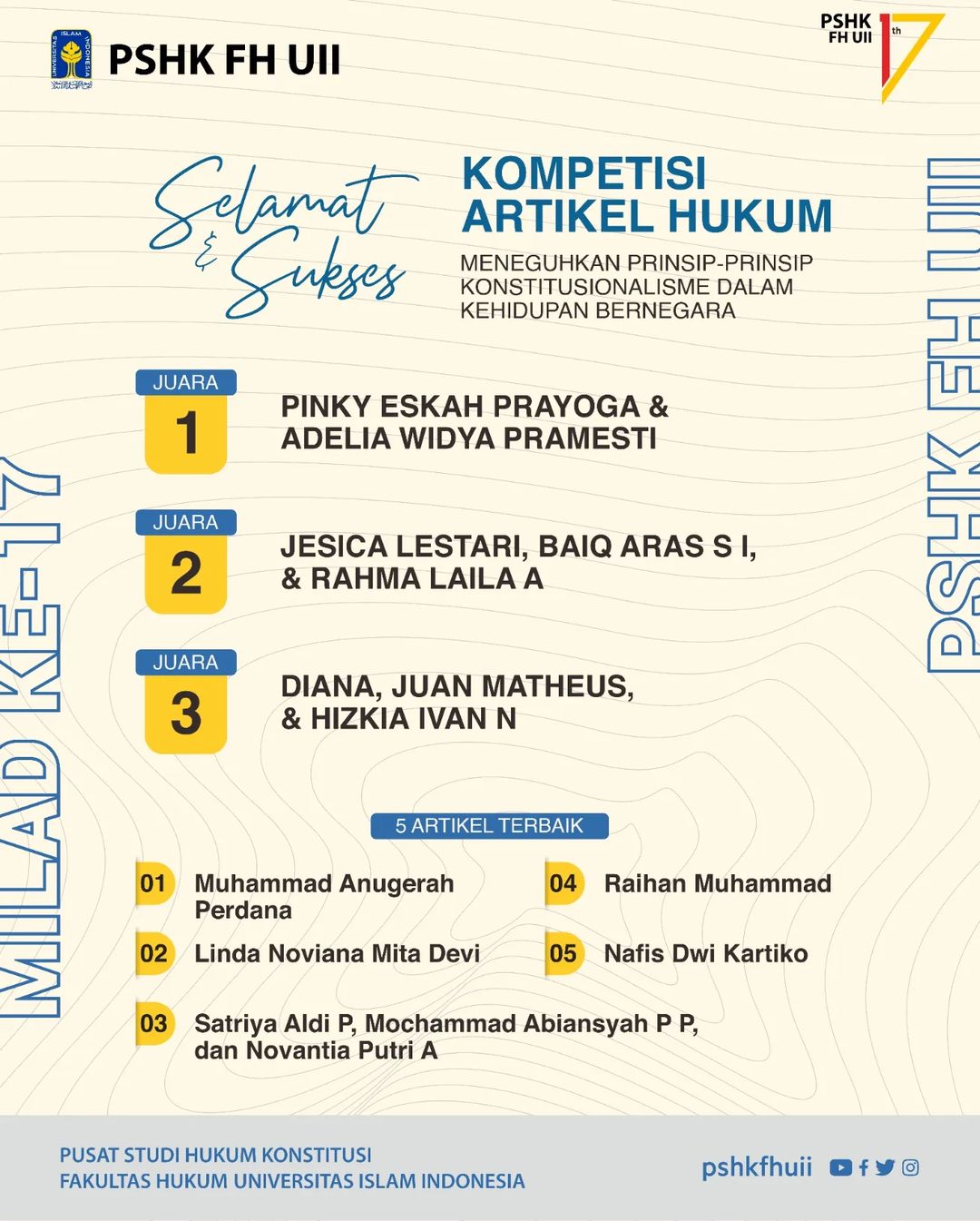

Proud! Nafis Dwi Kartiko again scored achievements in the national arena at the 17th Milad PSHK FH UII National Law Article Competition organized by the Center for Constitutional Law Studies, Faculty of Law, Universitas Islam Indonesia. This time, he won the Top 5 Best Papers from dozens of articles contested

In the competition held on March 5, 2024, Nafis wrote an article entitled “The Constitutionality of Forced Efforts on the Examination of Preliminary Evidence in Tax Crimes”. According to him, this study focuses on analysis related to the implications of regulating forced efforts in examining evidence of the initiation of tax crimes regulated in Article 43A paragraph (1) and paragraph (4) in Article 2 number 13 of the Law of the Republic of Indonesia concerning Harmonization of Tax Regulations, as well as its relation to the constitution in force in Indonesia, namely the Constitution of the Republic of Indonesia in 1945.

His decision in writing this article certainly has a background. In addition to being registered as an professional class student of the Law Study Program of Universitas Pelita Harapan Surabaya Campus, Class of 2021, he works at the Directorate General of Taxes as an Account Representative. Therefore, a number of his works are closely related to taxation.

“This article further analyzes in depth the applicable legal framework and its implications for the rights of taxpayers as citizens. One of the principles used as material for analysis is the principle of no taxation without representation, which is a principle that emphasizes the importance of taxpayer participation in tax policy making, and must reflect fair and transparent representation,” explained Nafis.

He added that the results of the study show that there is a lack of legal mechanisms for taxpayers to challenge coercive efforts to create legal uncertainty, contrary to the principles of justice, equality before the law, and protection of human rights. This undermines trust in the legal system and requires clarity on the legal action taxpayers can take.

“I hope the results of this study explain the need for a clear, fair, and consistent legal framework to strengthen public trust in the tax system and government, as well as support the active participation of taxpayers in tax policy making,” he said.

With various activities at work, Nafis chooses to always be productive in conducting research and participating in various scientific writing competitions and conferences. Some of his achievements include: 2nd Place in Call for Paper at The 9th East Java Economic Forum 2022,

Winner of Hope for Call for Paper at The 10th East Java Economic Forum 2023, and Best Paper in the Banking Sector for Scientific Research Works (KARISMA) of the Financial Services Authority Institute (OJKI) in 2023.

In addition, Nafis has also published a book “Guide to Fulfilling Tax Obligations for Government Agencies” in 2023. Not only that, he also succeeded in publishing his work in an internationally accredited journal, Scopus Q2, in February 2024.

This student with a Grade Point Average of 3.97 hopes that all his achievements and achievements can spur the enthusiasm and motivation of students of Universitas Pelita Harapan Surabaya Campus to more regularly participate in competitions in the future. Of course, with determination and perseverance, all can achieve what they dream of.

VIVA HUKUM!!

Author’s Greetings – JEI, NDK, and AAI